The student loan issue

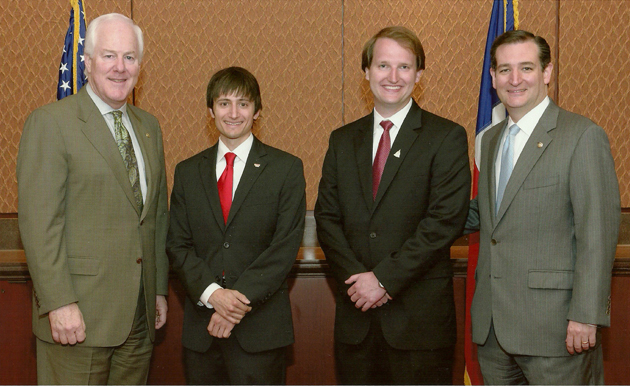

D3 Taylor Koren and Dr. Matthew Burks ’13 with Texas senators John Cornyn and Ted Cruz during National Dental Student Lobby Day this spring

As summer heated up, so did the discord surrounding student loan interest rates. Now we hear from this D3 who placed himself squarely in the middle of the debate.

With the average student loan debt for graduating college seniors topping off at nearly $27,000 based on 2011 figures — that number reached more than $220,000 for dental students — the possibility earlier this summer of an increase in interest rates was an unwelcome premise. The lowered interest rate for subsidized Stafford Loans set in place since 2007 was set to expire July 1, effectively doubling the fixed rate for new undergraduate loans from 3.4 to 6.8 percent. While dental students and residents are not eligible for these loans, the change stood to directly impact dental hygiene and undergraduate predental students. To make matters worse, there was no guarantee Congress would find a fix.

Panic set in, and student advocacy groups — the American Student Dental Association included — sprung into action. Among their ranks was D3 Taylor Koren, legislative coordinator for ASDA districts 8 and 9. Now, he tells us some of the efforts involved in making H.R. 1911, the Bipartisan Student Loan Certainty Act of 2013, a reality.

NewsStand: Advocating for lower student loan rates is no small feat. No doubt there were myriad groups working in tandem with ASDA to keep loan interest rates from doubling. What organizations partnered with ASDA, and what was it like organizing all these different efforts into one united voice?

Koren: ASDA mainly operated independently in its advocacy efforts for the passage of H.R. 1911. The American Dental Association also synchronously supported the bill’s passage with a letter to Congress, and both organizations sent “action alerts” — aka call-to-action notifications — to their members.

For its advocacy efforts, ASDA unveiled its Engage system — a website that allows members to submit letters to their congressional members for the support of federal legislation. Action alerts containing a link to the Engage site were sent to the entire ASDA membership, soliciting support for advocacy for the passage of H.R. 1911, and 812 ASDA members responded within a week’s time! This unprecedented support definitely maintained weight on the Hill, and I’m happy to report that ASDA played a significant part in the bill’s passage.

NewsStand: With Congress at a nearly record low pace for passing laws, the fact that this legislation has been approved and signed off by our president is significant. What were some of the specific hurdles that had to be overcome to make this happen?

Koren: After being introduced in the House of Representatives on May 9, this bill passed two House committees, as well as a vote on the House floor, where it passed and then was delivered to the Senate floor, where it was amended and passed, and then sent back to the House for a final vote. A week prior to its Aug. 9 passage, nearly three months after its introduction, govtrack.us estimated that H.R. 1911 had a 41 percent chance of enactment. Thankfully, with the focused support from ASDA members in advocating for H.R 1911, legislators were able to remain educated on the needs of their constituents regarding federal student loans and were empowered to cast their vote in agreement.

The enactment of this legislation, at a time when partisanship and congressional stalemates dominate the Hill, signifies both the importance and bipartisan support this bill received.

Absolutely Congress is at a record low pace for passing legislation. Please keep in mind that the congressional framers purposefully created a convoluted process to enact legislation, and even well-supported bills have a tough time becoming law. Currently, our system is functioning perfectly in limiting the passage of strictly partisan policies.

NewsStand: No one wants to be caught off guard with rising interest rates when thousands of dollars of debt are at stake. What practical advice do you have for fellow classmates to avoid being taken by surprise on student loan news?

Koren: For students wishing to remain informed on the latest news and developments on the Hill, I recommend they follow their congressional representatives on social media sites, as well as stay up to date on the legislative schedule, which may be found online with video proceedings.

—Jenny Fuentes